India is currently facing a significant challenge with its rising public debt alongside growing household debt, especially through microfinance. These twin issues raise concerns for both economic stability and the financial health of millions of Indian families.

Understanding Public Debt in India

Public debt, also known as national debt, is the total amount a government owes to lenders. It includes money borrowed from within the country (internal debt) and from foreign sources (external debt). As of March 2025, India’s total public debt reached approximately ₹181.7 trillion (about $2.14 trillion), and it is expected to increase to nearly ₹196.8 trillion by March 2026. Most of this debt ,around 96.6%, is internal borrowing, with the rest coming from external sources.

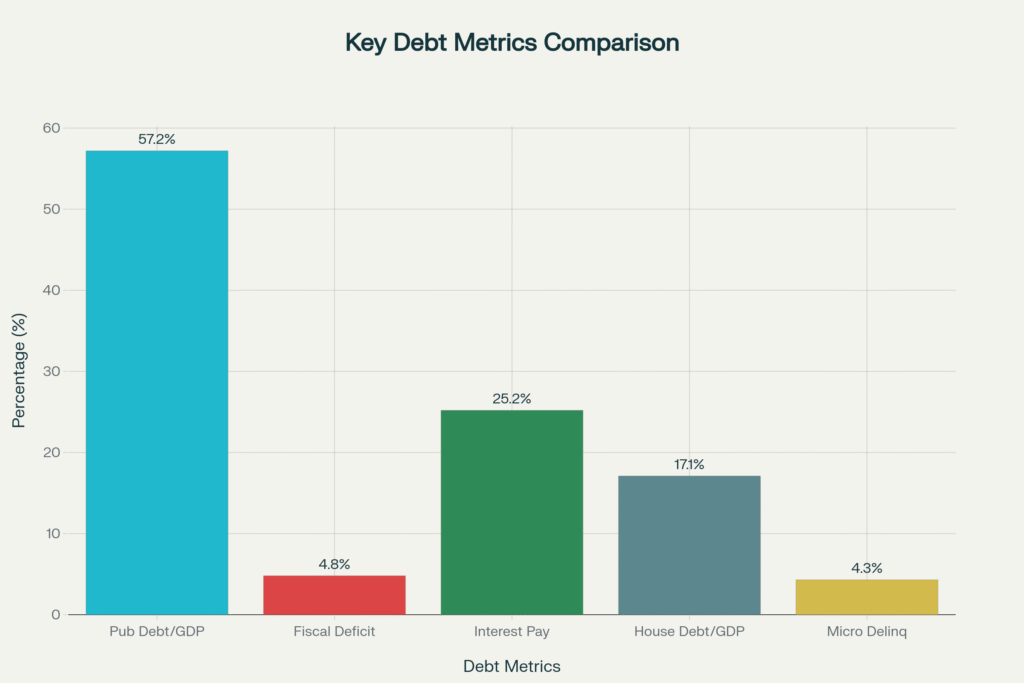

Public debt in India is high relative to its economic output. The government’s debt-to-GDP ratio stood at about 57.2% in 2024-25, with forecasts suggesting this could rise to around 80% when considering all liabilities. The Indian government spends a large part of its revenue on paying interest for this debt—about 35.7% of revenue receipts in 2024, which translates to around ₹12.76 lakh crore (25.2% of total government expenditure). This means less government money is available for essential services like health, education, and infrastructure.

Fiscal Deficit and Government Spending

The fiscal deficit, the gap between government income and expenditure, was 4.8% of GDP in the financial year 2024-25, which amounts to ₹15.7 lakh crore. The government aims to reduce this deficit to 4.4% in the current year, but early data shows the deficit remains high, with ₹4.68 lakh crore spent as of July 2025. The government spending includes subsidies, salaries, pension payments, and COVID-19 related welfare programs, all contributing to the rising debt levels.

India’s External Debt Situation

India’s external debt has also been rising sharply, reaching $736.3 billion (about ₹61 lakh crore) by March 2025, a 10% increase over the previous year. The external debt to GDP ratio has inched up slightly to 19.1%. This debt is largely in US dollars (54.2%), with the rest in rupees and other currencies. Key borrowers include non-financial corporations, deposit-taking institutions, and the government.

The Microfinance Boom and Household Debt

Alongside public debt, household debt in India is rising at a concerning pace. The household debt-to-GDP ratio has jumped to around 41.9%, a record high for India. Microfinance institutions (MFIs) are a major player here, providing small loans to millions of low-income households, especially in rural areas.

The microfinance sector’s portfolio stood at about ₹4.33 lakh crore by March 2024, serving nearly 7.8 crore clients. These loans help households start or grow small businesses, improve agriculture, and meet emergency needs. However, the debt burden on many families is increasing dangerously.

Growing Debt Burden and Risks for Households

The average household debt per borrower has grown from about ₹3.9 lakh in 2023 to ₹4.8 lakh in 2025, a 23% increase in two years. Many borrowers take multiple loans, with over 53% of Indian households now borrowing money. Among those borrowing from MFIs, 22% have loans from more than three lenders, raising the risk of unsustainable debt levels.

Delinquencies in microfinance have worsened, with the percentage of late or unpaid loans doubling in 2024 to 4.3% overall, hitting over 5% in some states like Bihar and Tamil Nadu. These defaults create a dangerous cycle where households struggle to repay loans and lenders reduce credit availability, affecting livelihoods.

Economic Dangers of Rising Debt

The combination of high public debt and mounting household indebtedness poses several risks to India’s economy:

- Fiscal Constraints: Heavy debt servicing (interest payments) limits government spending on crucial development and social services. With over a quarter of government spending devoted to interest, there is less room for growth-oriented investments or economic stimulus in downturns.

- Limiting Private Investment: Large government borrowing can lead to higher interest rates, making it costlier for private businesses to invest and grow. This can slow down economic progress.

- Inflation and Monetary Policy Risks: To manage high debt, the government might rely on deficit financing or monetization, increasing the money supply, which can stoke inflation. The Reserve Bank of India faces the challenge of balancing inflation control with supporting growth.

- Household Financial Stress: Rising microfinance defaults reflect growing financial distress for many families, reducing their ability to consume and invest in their futures. This could worsen poverty and inequality, particularly in rural areas.

- Intergenerational Debt Burden: Increasing debt levels mean future generations will face heavier tax burdens and fewer public resources. This threatens the long-term sustainability of government finances and social welfare.

- Credit Ratings and Investor Confidence: Continued high debt may lead to credit rating downgrades, increasing borrowing costs, and reducing foreign investment. This can add to economic vulnerabilities.

Measures to Manage Debt

To address these challenges, the government has articulated a plan to reduce the debt-to-GDP ratio to about 50% by 2031 through fiscal reforms, improved tax collection, subsidy rationalization, and prudent borrowing. Active debt management tools like bond switching to extend debt maturity profiles are also being used to ease repayment burdens.

For the microfinance sector, regulators have introduced stricter borrower assessment rules and limits on total borrowing by an individual to prevent debt traps. Programs promoting financial literacy and better debt counseling are increasing to help vulnerable borrowers.

While both public and household debts are important for financing growth and social inclusion, their rapid rise in India makes it critical to maintain control and ensure borrowing is sustainable. Otherwise, the risk of economic instability and hardship for millions of families grows.

External Sources:

- https://www.indiabudget.gov.in/doc/rec/annex9.pdf

- https://economictimes.com/news/economy/indicators/debt-to-gdp-ratio-falls-but-interest-payments-increase-cag-report/articleshow/123371000.cms

- https://timesofindia.indiatimes.com/business/india-business/foreign-debt-climbs-indias-external-debt-rises-10-to-736-3-billion-in-fy25-debt-to-gdp-edges-up-to-19-1/articleshow/122118155.cms

- https://www.business-standard.com/economy/news/india-household-debt-lower-than-emes-non-housing-loans-at-55-percent-125063001257_1.html

- https://upstox.com/news/upstox-originals/latest-updates/india-s-household-debt-is-rising-what-does-it-mean-for-its-economy/article-178985

- https://rmaindia.org/microfinance-sector-grapples-with-rising-delinquencies-amidst-industry-challenges

Disclaimer:

I provide the information and my views on the website only to educate people, new investors, and stock market enthusiasts on equity and other market investments. Please consult a SEBI registered financial advisor before making any investments in the stock or commodity markets. In case of any queries, you can contact me on Contact Form or email: admin@valueinvestingonline.in.